When Banks Say No, We Say Yes.

Fast, flexible funding for ambitious businesses. Over $50 million funded. 97% match rate. No hard credit pull. No red tape.

Our Benefit

Our benefit is providing personalized investment strategies that maximize returns while minimizing risk, ensuring your financial growth and security.

Tailored Funding Solutions

We understand that every business is unique. Our funding options are customized to fit your specific needs, ensuring you get the capital required to grow and thrive.

Fast Approvals

Time is money. Our streamlined process ensures quick approvals, so you can focus on what matters most running your business.

Flexible Terms

We offer flexible repayment plans tailored to your business's cash flow, making it easier to manage your finances and plan for the future.

Who We Are

Shaping the Future of Wealth, One Strategy at a Time

At Blue Table Investments, we do more than manage assets — we build financial futures. With over 20 years of industry insight and a commitment to excellence, we’ve earned a reputation as a trusted partner for businesses seeking smart, sustainable growth.

We specialize in custom investment strategies tailored to your goals, whether you're scaling operations or securing long-term wealth. Grounded in trust, transparency, and proven performance, we deliver solutions that empower you to grow with confidence.

Customized Investment Plans

Trusted Experts, Real Results

20+

Years Experience

Tailored Funding Solutions

We specialize in providing customized financing options for businesses that traditional banks often overlook.

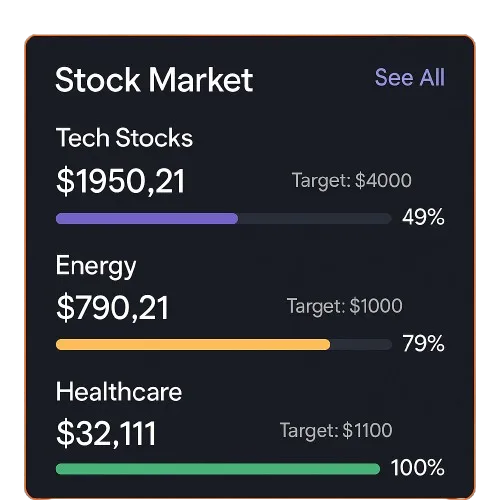

Transparent and Competitive Rates

Enjoy clear, upfront pricing with competitive interest rates ranging from 8% to 12% APR.

Dedicated Support Every Step of the Way

Our experienced team is committed to guiding you through the funding process with personalized support.

What Client Say

Here's what our clients have to say about their experience with our investment services:

The personalized attention and expertise I received helped me achieve financial growth I never thought possible.

James Smith

Office Manager

Working with their team has transformed my financial outlook—they truly understand my goals and needs.

Rachel Lee

Office Manager

Their strategic approach to managing my investments has given me peace of mind and consistent returns.

Michael Chen

Office Manager

Frequently Asked Questions

How long will it take to get funded?

Funding depends on the execution of the term sheet and delivery of the binder deposit and due diligence fee. Generally, after appropriate fees and deposits are received by Blue Table Investments, we fund on average between 45 and 90 business days.

Why are we being asked to send a binder deposit?

The binder deposit will serve as the asset to secure the funding date and initiate the in-depth underwriting process. The binder deposit will be held by a third-party financial institution and out of reach by both parties until the loan has been funded. After funding 50% of the binder deposit can be used to pay down the loan. When the loan has been paid down to 80% of the approved loan the remaining amount minus any fees can be returned to the client. All clients will sign a collateral agreement to ensure transparency. This agreement drafted by our attorney’s describes in detail the responsible parties, obligations, and ownership regarding funds in escrow.

Why are we being asked to send a non-refundable due diligence fee?

The due diligence fee is capital used to execute our internal review at Blue Table Investments in addition to an external review by our legal representation at our National Law Firm.

Is the term and rate fixed for the life of the loan?

Yes, both the rate and term are fixed unless the existing loan is modified.

Do we have ballon payments on our loans at Blue Table Investments?

No, all our loans are fully amortized unless a provision is included during which our client will execute an addendum providing them with details before closing.

Do you pull personal credit reports on the guarantors of the company requesting funding?

We will initiate a soft pull (no impact to your FICO score) on all guarantors who have 20% or more ownership stake of the organization.

Do you pull business credit reports?

Yes, we will pull your business credit score and report to check the financial health of the company borrowing the funds

Your trusted partner in financial growth and investment success, committed to securing your financial future.

Quick Links

1201 Peachtree Street Northeast Building 400 Suite 1740, Atlanta GA 30361

(404) 890-5662